family office alternative fund

Our main objective is to allocate assets, minimizing the risk of our investments at the most efficient rate. Thus we follow the diversification principle implementing market-neutral covered strategies, exploiting the long-lasting expertise of our team in various fields densely seasoned with data analytics and automation software.

Core Strategies

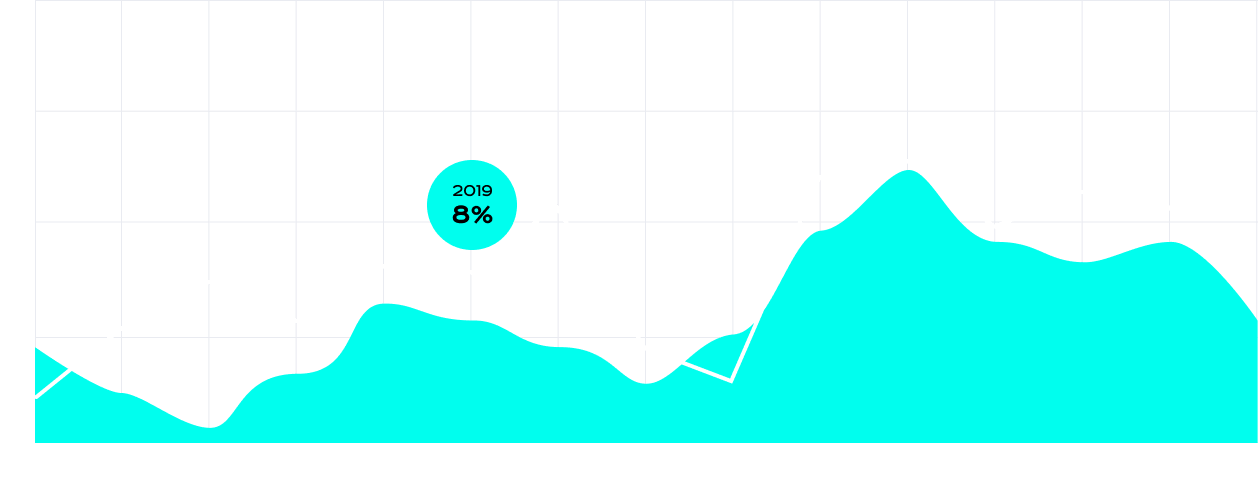

ГРАФИК ДОХОДНОСТИ

under the hood

Professional management team with core expertise in fields of operation.

Технологии

What we do

b19 alternative fund is an actively managed private fund that exploits key competencies of its team in various fields. Our team is extremely diverse in terms of experience and we are happy to have such a productive collaboration at our company. Each member is a highly-skilled professional with long-lasting experience working in his or her particular area of knowledge and network. We try to rationalize every piece of investment to pursue the optimal returns on investment. Every decision of our team is made under diligent data analysis and field research. We don't believe in coincidence, we do the math.

comparison of strategies